There’s no denying that self-pay (SP) is on the rise. It’s a clearly established trend. If you are looking to improve your facility’s financial performance, then the SP category must be a significant part of your revenue cycle focus. Here is a quick snapshot of the trends, some levers you can pull to drive improved performance, and some questions you should ask to determine the size of your SP collections improvement opportunity.

The Self-pay Outlook – 2018 and Beyond

In the future, healthcare providers can expect to see a continued increase in both uninsured (UI) and self-pay-after-insurance (SPAI) populations (collectively considered to be “self-pay”).

Uninsured + Self-Pay-After-Insurance = Self-Pay

Higher Deductibles

According to the Kaiser Foundation, enrollment in high deductible health plans has increased sevenfold over the past decade, and all signs point to a continuing trend in this direction(1).

|

Uninsured Patients

The average cost of a 2018 Health Exchange policy is expected to be 27% higher than it was in 2017(2). When combined with uncertainties and confusion around the future of the Affordable Care Act leading into the 2018 open enrollment season, along with the recent elimination of the “Individual Mandate” requirement, it is anticipated that overall enrollment in the Health Exchanges will decrease(3).

This means that the UI population will increase.

Higher Exchange Costs + Elimination of the Individual Mandate = Higher Uninsured (UI) Population

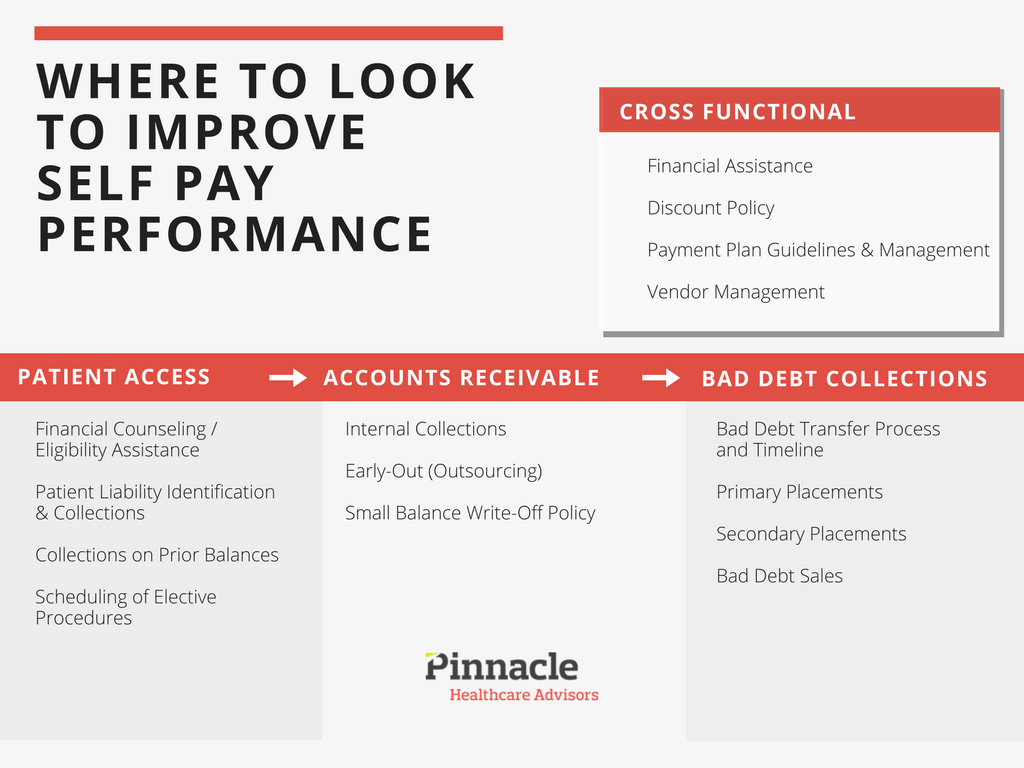

Where to Look to Improve Self-Pay Performance

There are many levers that you can pull to improve your self-pay revenue performance. The best place to start is to design an overall strategy that addresses all components of the self-pay portion of your revenue cycle, from patient access through bad debt collections.

Let’s Get Specific

Looking at bad debt write-offs by UI/SPAI at the patient level can be a great way to uncover opportunities and prioritize improvements.

We recently worked with a typical facility, dealing with a Self-Pay opportunity:

Not surprisingly, the emergency department (ED) was the largest source of the facility’s bad debt. Their primary driver was UI patients, but there was also a significant amount of SPAI flowing into the bad debt category as well. Through our structured assessment process, it was determined that if the organization were to provide greater financial counseling and eligibility screening coverage – they could convert more UI patients to Medicaid and Health Exchange plans.

There was also an opportunity to implement Emergency Medical Treatment and Labor Act (EMTALA)-compliant bedside financial screening and patient liability collections in order to reduce both UI and SPAI risk.

Additionally, looking at ED bad debt transfers by patient uncovered opportunities to create solutions for “frequent fliers.” These included scheduled financial counseling visits at the hospital or patient home and setting patients up with alternative options for primary care.

Establishing Meaningful Targets

One of the biggest opportunities we see for improving SP collections effectiveness is establishing meaningful targets. We find the best metric to effectively measure SP collections is to establish a collection rate that calculates:

SP Cash Divided by “SP Opportunity”

*SP Opportunity includes SP revenue (net of uninsured and financial assistance discounts) + the patient liability portion of insurance allowables (SPAI).

After evaluating current performance, meaningful targets can then be established.

Questions to Ask

Here are some questions that are critical in evaluating Self-Pay cash collections:

- What is your self-pay payer mix including SPAI?

- What is the total SP opportunity that could be collected?

- What is the right overall SP collection rate target based on payer mix and other factors?

- How much bad debt can we potentially convert to cash and more favorable write-off types such as financial assistance or contractual allowances?

Based on historic trends and continued uncertainties with the regulatory environment, it is likely that the Self-Pay collections opportunity will continue to grow.

If you would like to discuss strategies for improving your Self-Pay collection rate – contact Pinnacle Healthcare Advisors.

References:

(1)High Deductible Health Plan(HDHP) Enrollment: The Kaiser Family Foundation 2017 Employer Health Benefits Survey (Health Plans with at least $ 1,000 deductible for individuals, or $ 2,000 for families)

(2) https://www.npr.org/sections/health-shots/2017/10/30/560836963/shop-around-subsidies-may-offset-your-2018-health-insurance-price-hike

(3)http://www.healthleadersmedia.com/health-plans/lower-aca-enrollment-forecast-2018