As the mix within Medicare continues to shift from traditional to managed plans, hospitals that don’t take steps to address the differences in administrative expectations and claims processing between plan types run the risk of increased denials and mounting accounts receivable (AR).

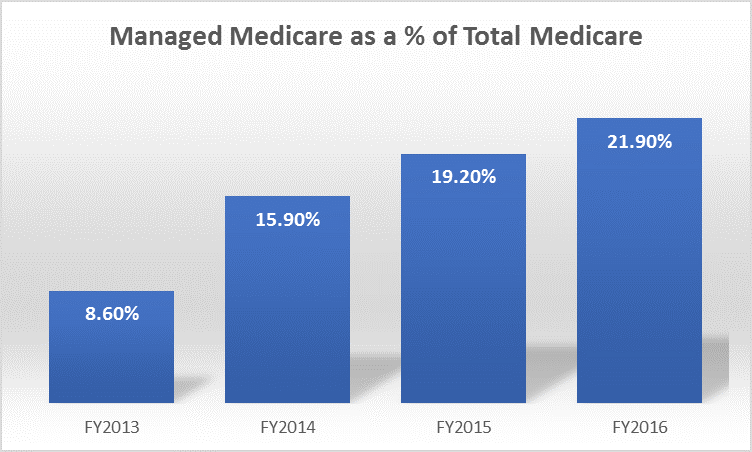

Does your mix look like this?

The Kaiser Family Foundation, in its 2017 Medicare Advantage Spotlight Report, states that:

“Both the Congressional Budget Office and the Health and Human Services (HHS) Office of the Actuary (OACT) project that Medicare Advantage enrollment and penetration rate will continue to grow over the next decade, with CBO projecting that about 41 percent of Medicare beneficiaries will be enrolled in Medicare Advantage in 2026. Enrollment will likely grow more in some parts of the country than in others, reflecting the diversity of markets and the coverage decisions of beneficiaries.

The Difference Between Medicare and Medicare Advantage Plans

Traditional Medicare is rules-based. When guidelines for care are followed and claims are billed correctly, Medicare pays quickly – typically within 14-21 days. But Medicare Advantage Plans (MAPs) follow much more of a commercial flow, and the expected payment for these plans is in the 40-45 day range at best. There are several factors that hospitals need to be aware of in managing this difference:

- It’s a different model. MAPs are handled by commercial payers, so they are much more likely to play games, request medical records as a means to delay payment, and deny claims for not meeting any number of “hoops” through which you must jump.

- The quality of the commercial payer can have a huge impact on your revenue cycle. If the consumer is covered by a high-quality payer, then reimbursements can be timely and denials minimal. Lower quality payers can be significantly harder to deal with – they will do anything and everything to deny or delay payment.

- Negotiating terms is important. While traditional Medicare is a fairly straightforward “if this, then that” model, MAP reimbursements can be highly influenced by relationships with payer representatives and your strategic approach to payer meetings. This is a business model that requires negotiation skills.

Three Strategies to Manage the Trend

It’s not going to stop. The trailing edge of Baby Boomers is going to continue to enroll in MAPs, and the effectiveness of your revenue cycle depends on how you deal with these two distinct populations. Hospitals that recognize this will focus on the following strategies:

- Separate Your Populations. From a systems perspective, this is typically accomplished by adding a separate financial class for traditional Medicare v. MAPs. You should expect to evaluate cash flow, A/R, agings, and overall reimbursement rates differently for these two plan types (and by each unique MAP payer!) – and your systems configuration and reporting approach should reflect these differences.

- Separate and Train Your Teams Appropriately. The skills required to resolve revenue issues are remarkably different between Medicare and MAPs. Resolution of traditional Medicare issues typically involves strict adherence to Medicare guidelines and staying up to date on CMS changes. MAP reimbursement issues, however, require a different skill set. These teams need to master skills as such as recognizing delay tactics, understanding payer contract terms, or better managing the administrative requirements of a contract. Notification or authorization requirements can overwhelm an untrained staff.

- Educate the Front End – When patients enter the continuum of care, staff education in the Patient Access and Utilization Management areas is critical. These key resources need to be trained to recognize the difference between plans when initially engaging with patients. The most important skill is to know how to successfully identify and secure a MAP account.

Signals that Indicate You Have a Problem

Hospitals that don’t break out traditional Medicare and MAPs separately in their revenue cycle processes make it extremely difficult for employees to manage the business. Murky “red flag” scenarios include:

- AR seems high, but depending on the plan mix, a 40-45 AR day range might be good – or it might be miserable!

- Mixed Medicare processes and measurements make it very difficult to determine whether AR issues are driven by billing accuracy, payer delay tactics, internal process issues, or unfavorable contract terms.

- Cash factor/reimbursement rates are indistinguishable. MAPs should be paying more than 100% of Medicare to account for the administrative and denial tasks that aren’t present with traditional Medicare. And breaking out the two populations will allow you to see the real impact of MAP denials and other delay tactics.

Questions We Can Help Answer

In our experience, hospitals should have metrics and processes in place to answer on-the-spot questions such as:

- What is my mix of Medicare vs. MAP and how has that been changing over time?

- How are we performing in each segment of revenue, and what are our key metrics?

- What are the shifts within our MAP payer mix (e.g. movement from Blue Cross to Humana), and how are they impacting our financial performance?

- Do we have separate and unique controls and strategies for each segment? And if so, are we pulling all the appropriate levers to keep our AR as clean as possible?

- Are we positioned to manage a population that increasingly behaves more like commercial plans than Medicare?

- Are we effectively negotiating MAP reimbursement rates and contract terms?

Your Medicare population is shifting towards MAPs, and if you’re not sure how to adjust your teams to deal with it, contact Pinnacle Healthcare Advisors and we can talk strategy. Or just call us at 218.591.3607.